arizona estate tax exemption 2020

A property tax refund credit of up to 502 is available against Arizona income taxes for homeowners or renters age 65 or older with total household income less than 3751. Federal law eliminated the state death tax credit.

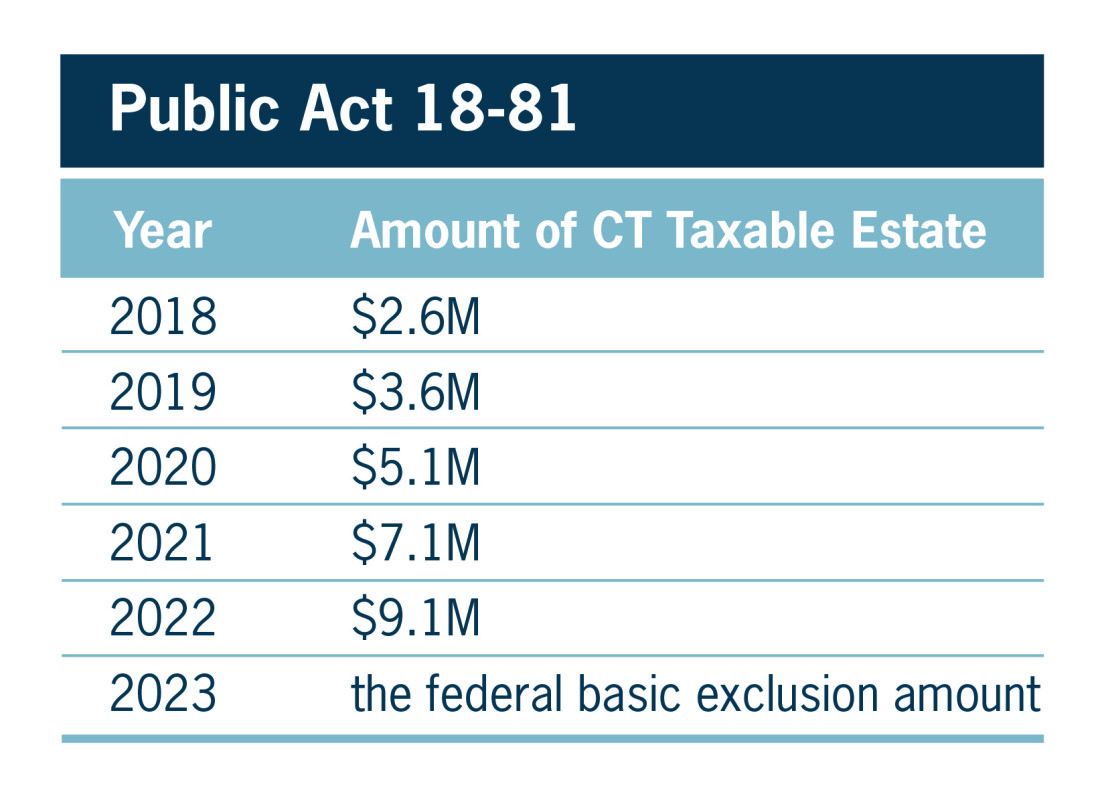

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation.

. Form 706 Estate Tax Return Packages Returned If your Form 706 package was returned to you you must. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Arizona estate tax exemption.

In fact there are no forms or filing requirements to notify Arizona of your estate at all. 1 which increased the Minnesota estate tax exemption for 2017 from 1800000 to 2100000 retroactively and increases the. Notice 2020-20 Federal income tax filing and payment relief on account of.

Arizona has conformed to federal so there are no longer personal. The Estate Tax Exemption Amount Goes Up for 2021 Serving Queen Creek Gilbert Mesa. Arizona has neither an estate tax a tax.

Every authorized society and every society that is exempt under section 20-893 is deemed to be a charitable and benevolent institution and is exempt. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Arizona estate tax. On May 30 2017 the governor signed the budget bill HF.

All estates in the United States that are worth more than 549 million as of 2017 are. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following. Every corporation doing business pursuant to this article is declared to be a nonprofit and benevolent institution and to be exempt from state county.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The amount of the federal estate tax exemption is adjusted annually for inflation.

This page discusses various sales tax exemptions in Arizona. Arizona is one of 38 states that does not assess an estate tax.

Tax Filings For Estate Bouman Law Firm

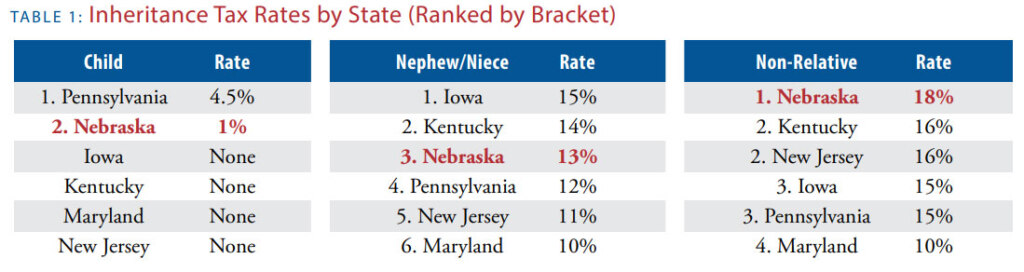

Death And Taxes Nebraska S Inheritance Tax

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift Tax Exclusion Rules Appreciated Assets Gifts Phoenix Tucson Az

What Is Arizona Homestead Act 5 Most Common Questions Answered

Arizona Estate Probate 520 Home Buyers

Arizona Society Of Enrolled Agents Faq

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Planning Articles Loose Law Group Az

New Arizona Homestead Laws Will Delay Many Real Estate Transactions Macqueen Gottlieb Plc

How Do State And Local Individual Income Taxes Work Tax Policy Center

Estate Tax Planning In Arizona Inhertence Tax Plans Arizona Law Doctor

Is There An Inheritance Tax In Arizona

How Do State And Local Sales Taxes Work Tax Policy Center

Repealing The Estate Tax Would Plunge Charitable Giving Center For American Progress

State Death Tax Chart Resources The American College Of Trust And Estate Counsel

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj